Evaluation of Technical Trading methods

Upon examination and extensive testing of some technical trading methods, it appears

that most methods suffer from a large percentage of false positives. The easy way

to sort though this mess is to show a P & L (Profit & Loss) curve along

with an OHLC price chart with Long, Short, and Cover symbols.

Click on charts with blue boarders for a larger image.

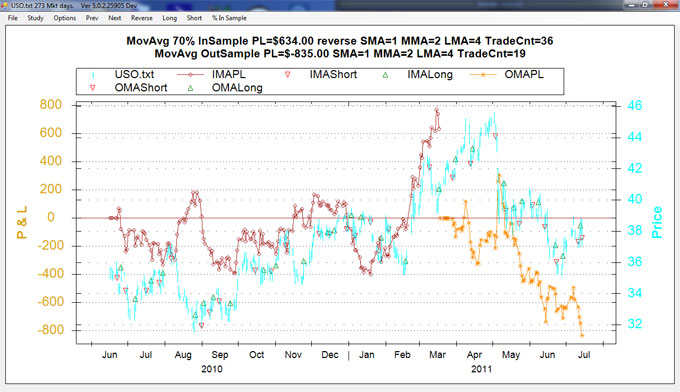

From EODTT: This chart shows a profit of $634.00 for the in sample segment of the

chart where we picked the three parameters with the benefit of hindsight. In the

next segment using the same parameters results in a loss of $835.00. Not very impressive,

and unfortunately typical. The out of sample performance is fairly random.

Chart generation sequence. Run End of Day Technical Trader (EODTT) software, select

market price data file (USO.txt) Any daily market data file downloaded from yahoo.com

will do. Select the Study (MovAvg), select % in Sample (70%). Note, above

plot total P & L (TPL) has been selected.

EODTT calculates the end of the in sample period profit for many combinations of

the three moving averages, short moving average (SMA), medium moving average (MMA),

and long moving average (LMA) and makes note of the parameters generating the highest

profit.

A long signal is generated when SMA>MMA>LMA, a short signal is generated when

SMA<MMA<LMA. The are also three modes (reverse, long, short) for the MovAvg

study. This chart had been run in the "reverse" mode.

In reverse mode, we are always in the market and we reverse our position when a

signal occurs. In long mode we only go long on a long signal and we cover on a short

signal. In short mode, vice versa.

So far I have mostly implemented the following technical trading studies,

Mono, Fisher, FishConfirm, MovAvg, ADX, Week_Segements, Regression, and MaxProfitH.

EWaveTrade

is a tool to aid in the process of

analyzing market price data using

the Elliot Wave Theory, particularly

applying the concepts and principles

developed by Glenn Neely. It is

claimed that the book "Mastering Elliott Wave" by Glen Neely is recommended

for both potential developers and users of this software."

I started out by downloading, compiling and testing the EWaveTrade software

Version 1.0. It worked nicely with the sample data files provided. When I tried

to use some more modern daily market data downloaded from Yahoo there were some

minor data conversion errors which were easy to fix with some minor changes to the

software.

From reading "Mastering Elliott Wave" by Glen Neely I gained a slightly

better understanding of reading the charts generated by the EWaveTrade software.

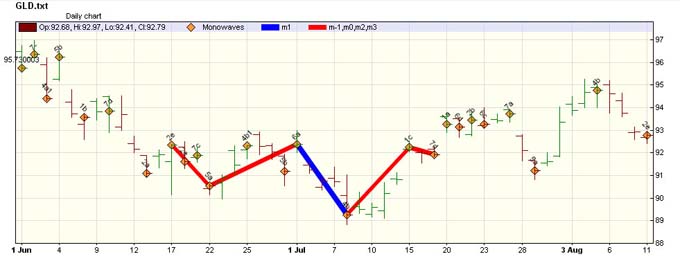

From EWaveTrade: Monowaves are denoted by the orange diamond symbols and use hindsight

of one market day.

Monowaves are defined as the beginning and end of a continuous trend where in the

long case each close is higher than the previous and in the short case vice versa.

Please note that the end of a monowave cannot be determined until one market day

after the end of a continuous trend.

Most of the time the five Elliott waves in red and blue simply connect each of the

monowaves. However, in the case above EWaves m-1 and m0, we see that two monowaves

are skipped above giving the illusion that EWaves show the larger trend turning

points. Unfortunately, the skipping of the monowaves only occurs in EWaves m-1 and

m0 never in EWave m3, and therefore too late to trade on. In other words the skipping

is done with the benefit of hindsight.

To verify this behavior, I modified the EWaveTrade software such that it did not

read in the entire market data at first and I added a button to read in one more

day each time the button was pressed. Then I could see the five waves change each

time another market day was added. The Elliott wave preformed no better than monowaves

which themselves use hindsight of one market day.

I do admit my interpretation on how to profitably trade Elliott wave theory may

be completely wrong.

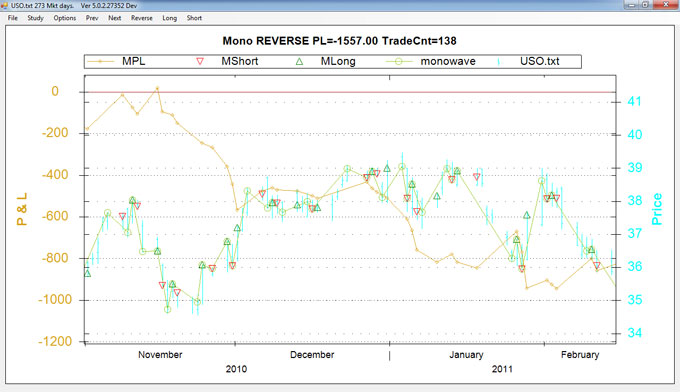

From EODTT: Trading as soon as the monowaves are defined, which is one day after

the trend changes.

Note for clarity, we zoomed into a section where the P&L and price curves are

near.

Trading based on monowaves resulted in poor performance for our test set.

Our test set consisted of GLD, SLV, SPY, and USO using the data range 2008-6-16

to 2011-7-14. Furthermore, GLD, SLV, and USO were each split into three segments.

Our test set was GLD1.txt, GLD2.txt, GLD3.txt, GLDAll.txt, SLV1.txt, SLV2.txt, SLV3.txt,

SLVAll.txt, SPYAll.txt, USO1.txt, USO2.txt, USO3.txt, USOAll.txt. Note, above

plot closed P & L (CPL) has been selected.

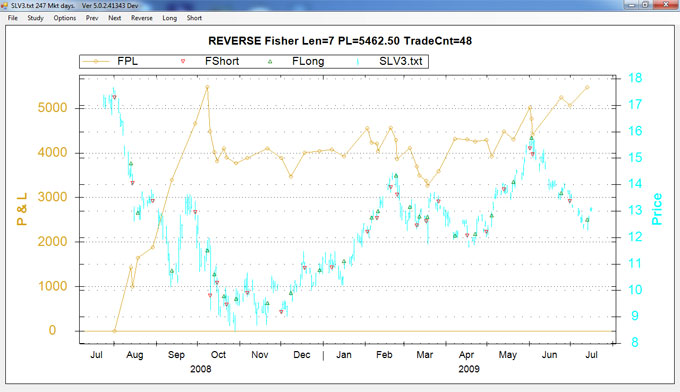

From EODTT: The fisher indicator has a "Length" parameter like a moving average.

The longer the length the fewer the trades. With hindsight we choose a profitable

"Length", Using the "Length" for the next two market data segments

results in less impressive performance. Closed P & L selected.

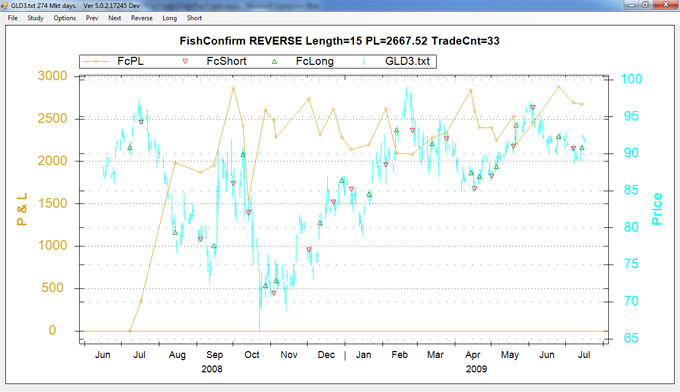

From EODTT: Fish Confirm is similar to the Fisher indicator, except that it requires

two consecutive consistent trend change indicators before entering a trade. Closed

P & L selected.

With hindsight for the "Length" we have good performance. Performance

with Length 15 stays good for GLD2.txt with P & L of $2757. and for GLD1.txt

of ($504). and GLDAll.txt with $4400.

Fish Confirm also preformed well with SLV3 with hindsight we choose "Length"

as 20. Giving results SLV3 P & L $7714, SLV2 ($2636), SLV1 $8218 and SLVAll

$15896.

USO3 with hindsight we choose "Length" as 4. P & L USO3 $4104, USO2

($3577), USO1 ($154) USOAll $2323. Draw your own conclusions.

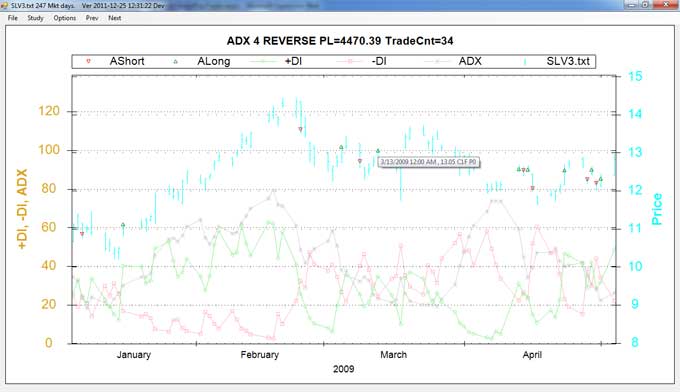

From EODTT: ADX, computes +DI, -DI and ADX, we go long when ADX > 25 and +DI

> -DI, we go short when ADX > 25 and +DI < -DI, we cover when ADX <

25. There is also a "Length" parameter. Total P & L selected.

With hindsight for the "Length" of 5 we have good performance for GLD3

with P & L of $2221. GLD2 ($1570) GLD1 ($419) and GLDAll

$187.

From EODTT: For ADX study P & L plot turned off and indicator plots appear.

We zoom into a section where ADX drops below 25 and see that a cover is executed

on March 13, 2009, Price 13.05, Cover 1 Fill, Position 0, which is displayed via

mouse over "3/13/2009 , 13.05 C1F P0".

With hindsight for the "Length" of 4 we have good performance for SLV3

with P & L of $4470. SLV2 ($2568) SLV1 $7198. and SLVAll

$11460.

Go on to Part 2

Buy End

of Day Technical Trader (EODTT) software.

Official Facebook Page

|